Introduction

Filing income tax returns (ITR) is a crucial responsibility for Non-Resident Indians (NRIs) with taxable income in India. NRI taxation entails several key considerations that individuals must be aware of to ensure compliance and maximize tax benefits. This article highlights the essential factors NRIs should consider while filing ITR in India. From understanding residential status and types of income to the applicable tax rates and exemptions, being well-informed about NRI taxation rules is essential. By navigating these considerations effectively, NRIs can fulfill their tax obligations, optimize their tax liability, and stay updated with the evolving tax regulations in India.

Critical Tax Considerations for NRI

Household Status

Understanding your tax duties as an NRI requires first determining your residency status. Based on their residence, people are divided into three groups under Indian tax law: residents, non-residents, and residents but not ordinarily residents (RNOR). NRIs are classified as non-residents if they don’t match the resident or RNOR status requirements. The range of taxable income, tax rates, and the types of income that must be reported on the ITR are all impacted by residential status.

Taxable Earnings

In India, NRIs must pay taxes on any income they earn or receive there. However, for NRIs, money earned outside of India is typically not subject to taxation in India. The following sources of income are frequently included in NRIs’ taxable income:

Income from Indian Sources

This includes wages earned in India, income from real estate located there, capital gains from selling assets there, and any other income earned there.

Interest income: For NRIs living outside of India, interest from savings accounts, fixed deposits, and other financial instruments is taxed in India.

Rent received: Rent received by an NRI who owns property in India is taxable in India. But certain tax deductions may be used for rental income.

Gains: NRIs must disclose capital gains from selling assets like mutual funds, equities, or real estate in India. Long-term capital gains are taxed differently than short-term capital gains.

Agreements to Avoid Double Taxation (DTAA)

NRIs who live in countries with which India has signed a double taxation avoidance agreement (DTAA) may benefit from these provisions. When the same income is taxed in both the home country and India, DTAA agreements seek to remove or significantly reduce the tax burden. Following the terms of the applicable DTAA, NRIs are eligible to apply for tax exemptions, deductions, or credits.

Income Tax Return Filing

Regardless of whether tax has been withheld at source, NRIs must file their ITR in India if their total income exceeds the statutory threshold. ITR filing aids in maintaining a record of income and tax payments, claiming refunds, and establishing compliance. Using the Income Tax Department’s e-filing platform, NRIs can submit their ITR online.

ITR Tax Filing Forms

The type and volume of income determine the best form to use when filing an ITR as an NRI. NRIs frequently utilize the following conditions:

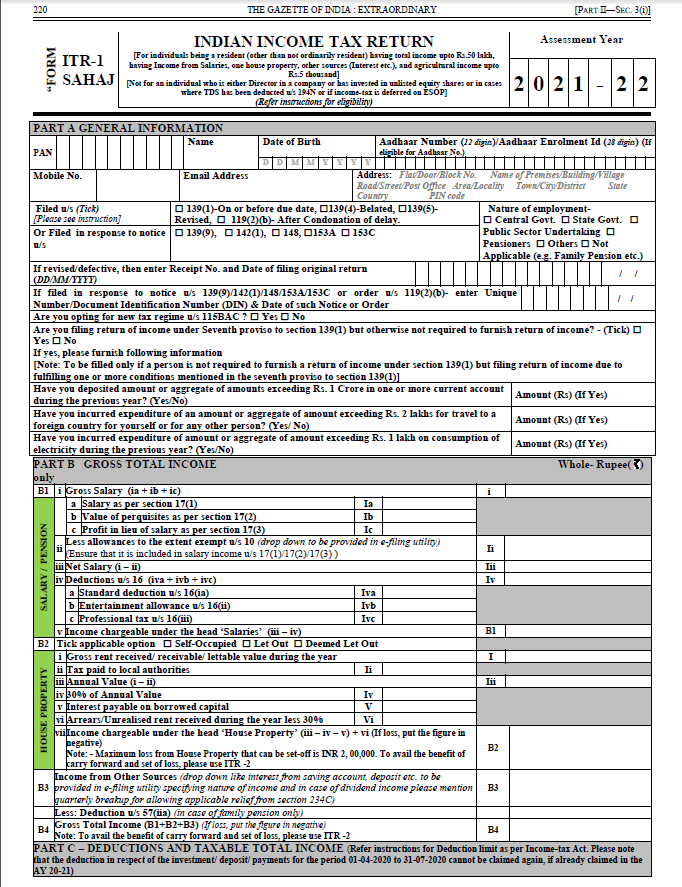

ITR-1

For people with income up to INR 50 lakh who receive it through a salary, a single residential property, and other sources (apart from winnings from lotteries and thoroughbred racing).

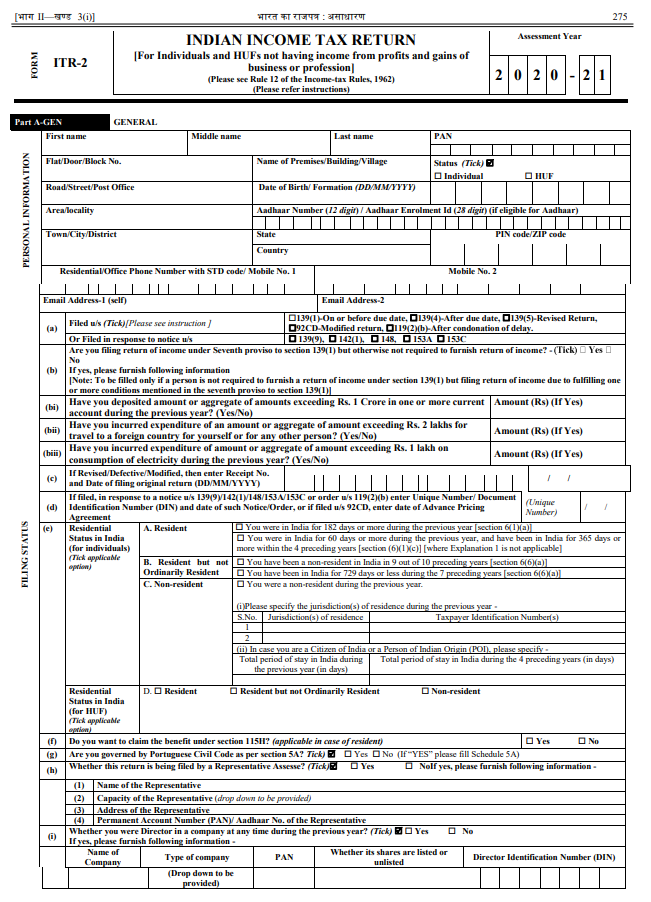

ITR-2

For people who earn money through salaries, rental income from numerous homes, capital gains, or overseas assets.

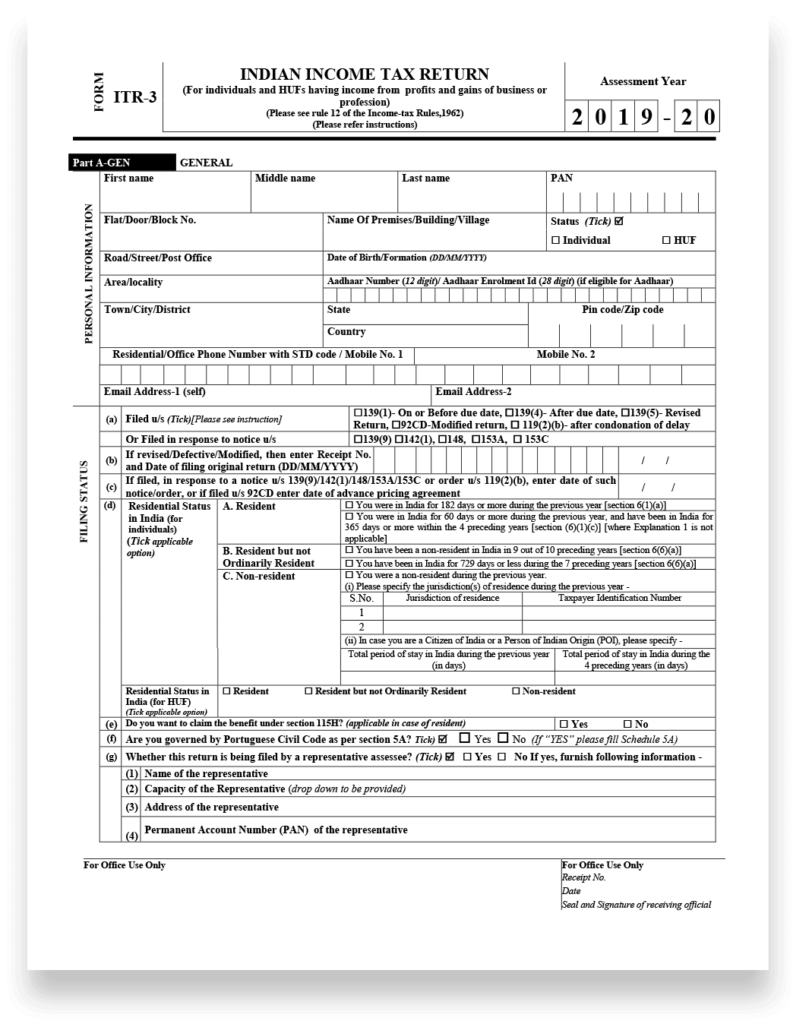

ITR-3

For people and Hindu Undivided Families (HUFs) who make money through a job or a company.

Tax Exemptions and Deductions

To lower their taxable income, NRIs can take advantage of several deductions and exclusions provided by Indian tax legislation. You can write off costs like mortgage interest, health insurance, and contributions to specific investment plans like the National Pension System (NPS) or Public Provident Fund (PPF).

Reporting and Bank Accounts

To handle their income and financial transactions by Reserve Bank of India (RBI) regulations, NRIs must keep certain types of specified bank accounts in India, such as Non-Resident Ordinary (NRO) and Non-Resident External (NRE) accounts. NRIs must also disclose to the Indian authorities their foreign assets and foreign bank accounts by the established reporting rules.

Respect for Important Deadlines

NRIs must understand the ITR filling’s last date and other tax-related requirements. Typically, NRIs have until July 31 of the assessment year to file their ITR. To avoid fines and interest costs, meeting these dates is crucial. So click on “File My ITR” and fill it up as soon as possible.

Professional Support

Due to the complexity of NRI taxation, you are strongly advised to get expert guidance from a certified online tax consultant or chartered accountant. They may offer precise advice on tax preparation, compliance, and maximizing benefits.

Conclusion

The critical factors to consider when submitting an ITR in India should be known to NRIs. To meet their tax duties in India, NRIs must be aware of their residency status, taxable income, deductions, double taxation agreements, due dates, filing requirements, and tax compliance. Expert counsel from a CA for ITR filling can offer more direction and guarantee correct adherence to Indian tax regulations.